Why Lifecycle Cost Analysis Beats “Lowest Bid” Thinking in HVAC Replacement

Share

When commercial HVAC systems reach the end of their service life, the first instinct is often to compare bids and pick the lowest price. But installation cost is only a fraction of total heating and cooling expenditures over the course of a system’s lifespan. Lifecycle cost analysis (LCA) looks beyond the installation number, helping building owners and property managers evaluate total ownership, including performance, energy use, maintenance requirements and longevity, before committing to a replacement.

Performance and Reliability

Low-bid equipment often meets minimum code but not long-term performance goals. Compressors, coils and controls may be selected primarily to cut upfront expense, which can compromise temperature control and system balance once installed. In multi-zone buildings or facilities with sensitive equipment, those inconsistencies can mean higher humidity, more noise and frequent service calls.

Being able to accurately predict how a system will perform throughout its lifespan, not just when it’s new, is vital. Factoring in load requirements, control responsiveness and expected wear allows decision makers to choose equipment that will maintain stable indoor conditions for the full duration of its operating life. Over time, steady performance translates to lower total operating costs and fewer disruptions for tenants or employees.

Equipment Longevity

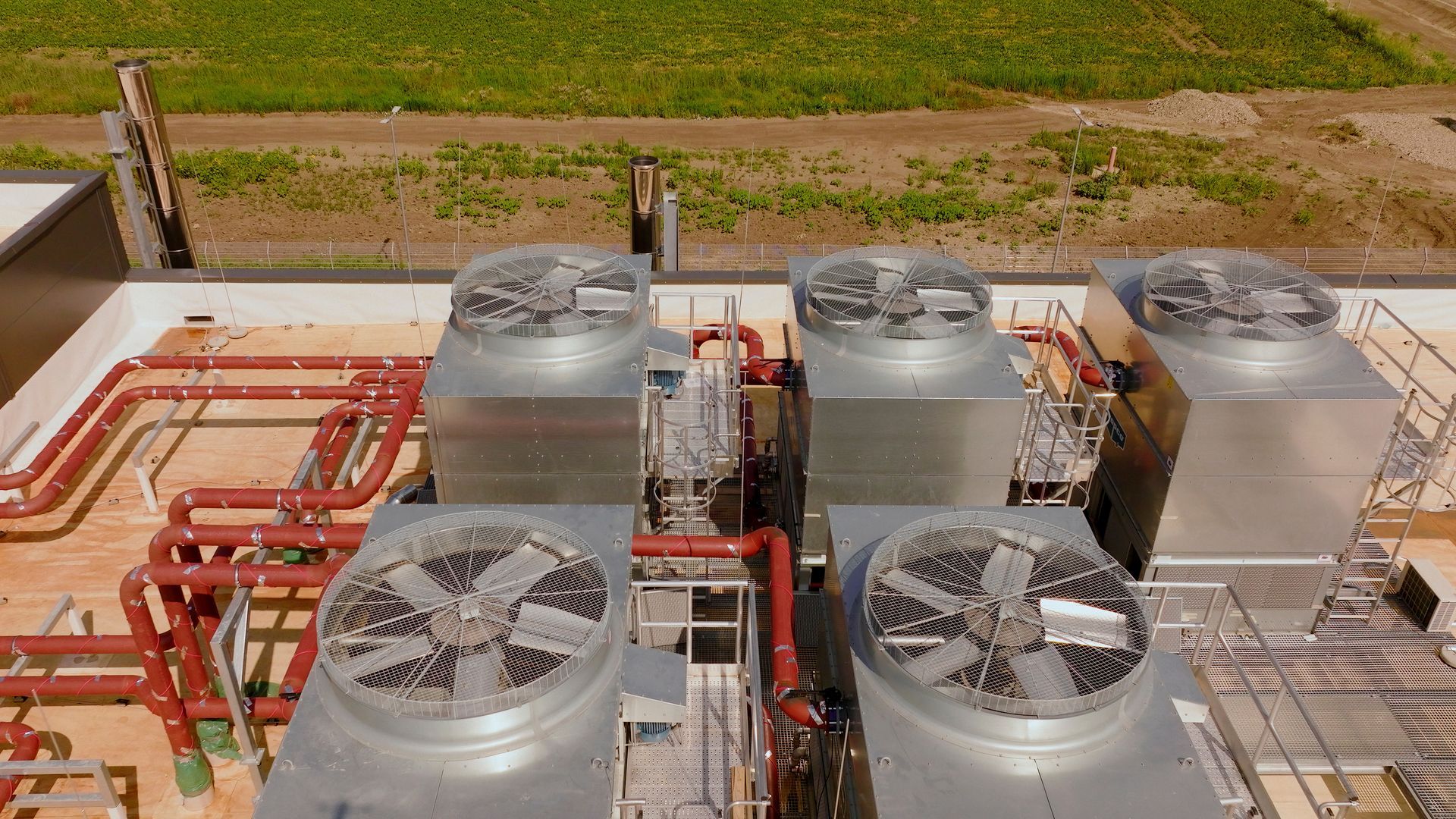

Facility managers and property owners understand durability is important, but concerns about system lifespan frequently take a back seat to the upfront cost of HVAC replacement. Lower-priced systems often use thinner metals, lower-grade coatings or less robust mechanical assemblies that wear out faster in demanding environments. For rooftop units exposed to Texas heat or difficult indoor environments, like those with high levels of grease and moisture, those low-quality components can reduce effective system lifespan.

Decision makers are best served by considering expected service life, warranty coverage and replacement intervals based on the unique variables present in their facilities. For properties with particularly demanding conditions, it can make sense to invest in an HVAC system that costs more initially but can last several years longer before major repairs or full replacement is needed.

That extra longevity defers another capital project and minimizes the business downtime associated with large-scale replacements.

Energy Efficiency and Operating Costs

Energy use typically represents the largest portion of a commercial HVAC system’s total cost. Even a modest difference in efficiency rating can compound over thousands of operating hours each year. Systems with variable-speed compressors, energy recovery ventilation and advanced control logic use less electricity while providing better comfort.

Quantifying those factors is a key aspect of LCA. A unit that runs more efficiently throughout its lifespan will have the potential to surpass the ROI of a lower-priced model long before another replacement is required. For property managers balancing budgets, that efficiency translates directly into lower utility bills and improved sustainability metrics, which can be especially attractive to tenants who monitor their own energy use.

Maintenance and Downtime

Maintenance costs are easy to underestimate when comparing bids. Equipment that requires specialized parts, frequent filter changes or complex access for service quickly adds hidden costs. Downtime for major repairs can also disrupt building operations, tenant comfort or production schedules.

Lifecycle cost analysis should incorporate predicted maintenance frequency, labor costs and downtime exposure in its calculations. Systems designed for accessibility and predictive maintenance reduce both reactive service calls and the likelihood of costly breakdowns. The goal is to establish a predictable maintenance budget instead of dealing with surprise expenses every few years.

Return on Investment (ROI)

When installation cost, efficiency, maintenance requirements and lifespan are considered together, the cheapest option rarely delivers the best ROI.

A true lifecycle comparison often reveals that spending more up front can reduce total ownership cost by a significant margin. That perspective is especially important for organizations managing multiple facilities or budgeting capital improvements over several years.

Reliable equipment keeps costs predictable, improves tenant satisfaction and aligns with long-term energy goals.

Building for the Long Term

Commercial HVAC systems are infrastructure, not disposable assets. The difference between a system that lasts 10 years and one that performs reliably for 20 can reshape a facility’s financial outlook. Approaching HVAC replacement planning as a measurable investment strategy rather than a short-term expense can pay dividends down the line.

Providing Honest and Transparent Answers to Commercial HVAC Questions in Arlington and Fort Worth

Tom’s Commercial helps property managers, building owners and facility operators evaluate HVAC replacements based on long-term performance, not just upfront purchase price. Call our commercial HVAC specialists at 817-857-7400 for a bid or to learn more about systems that balance up-front cost with energy efficiency, durability and total ROI.